Trust Foundation Integrity: Structure Trust in Every Job

Trust Foundation Integrity: Structure Trust in Every Job

Blog Article

Reinforce Your Heritage With Expert Trust Fund Foundation Solutions

In the world of legacy planning, the value of developing a solid structure can not be overemphasized. Expert depend on structure options use a robust structure that can protect your properties and ensure your dreams are performed specifically as meant. From lessening tax obligation responsibilities to picking a trustee that can properly manage your affairs, there are essential factors to consider that demand interest. The complexities involved in depend on frameworks necessitate a strategic method that lines up with your long-lasting goals and values (trust foundations). As we explore the nuances of trust structure remedies, we uncover the key components that can strengthen your tradition and provide a lasting impact for generations to come.

Advantages of Count On Foundation Solutions

Count on foundation remedies use a robust structure for securing possessions and guaranteeing lasting monetary safety for individuals and companies alike. Among the primary advantages of count on structure options is asset protection. By developing a depend on, people can shield their properties from potential threats such as suits, creditors, or unexpected financial commitments. This security makes sure that the assets held within the count on remain safe and can be passed on to future generations according to the individual's desires.

Additionally, depend on structure remedies provide a strategic strategy to estate preparation. With trust funds, people can outline how their assets must be handled and distributed upon their passing. This not only aids to prevent problems amongst recipients but likewise ensures that the person's heritage is managed and handled efficiently. Trusts likewise offer privacy benefits, as assets held within a trust fund are not subject to probate, which is a public and frequently lengthy legal procedure.

Kinds Of Depends On for Legacy Planning

When thinking about legacy planning, a vital aspect involves exploring numerous sorts of lawful tools created to protect and disperse possessions properly. One common type of trust utilized in legacy planning is a revocable living depend on. This depend on allows people to preserve control over their properties throughout their life time while making certain a smooth change of these possessions to recipients upon their death, staying clear of the probate process and supplying personal privacy to the family.

An additional type is an unalterable trust, which can not be modified or revoked once developed. This depend on provides possible tax benefits and safeguards assets from financial institutions. Charitable trust funds are likewise preferred for individuals aiming to sustain a cause while keeping a stream of earnings on their own or their beneficiaries. Unique needs depends on are essential for people with handicaps to ensure they get necessary care and assistance without jeopardizing government advantages.

Comprehending the various kinds of counts on offered for tradition preparation is crucial in developing an extensive method basics that straightens with specific goals and priorities.

Choosing the Right Trustee

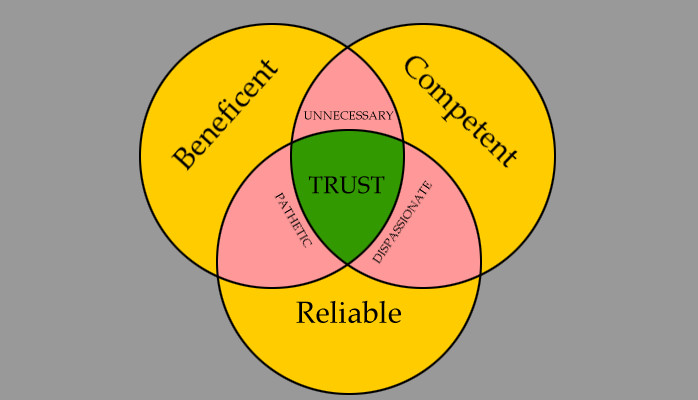

In the realm of legacy planning, an important facet that requires mindful factor to consider is the option of an appropriate individual to fulfill the critical role of trustee. Choosing the best trustee is a decision that can considerably affect the successful execution of a count on and the fulfillment of the grantor's wishes. When selecting a trustee, it is important to prioritize high qualities such as trustworthiness, economic acumen, honesty, and a dedication to acting in the finest rate of interests of the beneficiaries.

Ideally, the picked trustee needs to possess a solid understanding of economic matters, can making audio investment choices, and have the ability to browse intricate lawful and tax obligation demands. In addition, reliable communication skills, focus to detail, and a determination to act impartially are likewise important attributes for a trustee to have. It is suggested to choose somebody that is reliable, liable, and with the ability of meeting the responsibilities and commitments connected with the duty of trustee. By carefully taking into consideration these aspects and choosing a trustee who aligns with the values and goals of the depend on, you can aid ensure the lasting success and conservation of your tradition.

Tax Obligation Implications and Advantages

Considering the monetary landscape bordering depend on structures and estate planning, it is critical to explore the detailed realm of tax obligation implications and benefits - trust foundations. When establishing a count on, comprehending the tax implications is crucial for maximizing the benefits and lessening potential obligations. Depends on supply numerous tax advantages relying on their framework and function, such as lowering inheritance tax, revenue taxes, and present tax obligations

One substantial advantage of certain depend on structures is the capacity to move possessions to beneficiaries with decreased tax obligation consequences. For example, irrevocable trust funds can get rid of properties from the grantor's estate, potentially lowering estate tax liability. In addition, some depends on permit income to be distributed to beneficiaries, that may be in lower tax braces, resulting in total tax savings for the household.

Nonetheless, it is vital to note that tax regulations are intricate and subject to change, stressing the necessity of seeking advice from with tax obligation specialists and estate planning experts to ensure compliance and make the most of the tax benefits of trust structures. Correctly navigating the tax ramifications of trust funds can bring about considerable cost savings and a more efficient transfer of riches to future generations.

Steps to Developing a Depend On

To develop a trust fund efficiently, careful focus to detail and adherence to legal protocols are critical. The primary step in developing a trust fund is to plainly define the function of the trust and the assets that will be included. This includes recognizing the recipients who will certainly gain from the trust fund and appointing more helpful hints a credible trustee navigate to these guys to manage the properties. Next off, it is important to pick the sort of depend on that ideal lines up with your goals, whether it be a revocable trust fund, irreversible depend on, or living depend on.

:max_bytes(150000):strip_icc()/trust-fund-4187592-1-58df0cb75cbc432090ea169f30193611.jpg)

Conclusion

In final thought, establishing a trust foundation can offer many advantages for tradition preparation, including possession security, control over distribution, and tax obligation benefits. By picking the ideal sort of trust and trustee, individuals can secure their assets and ensure their desires are brought out according to their needs. Understanding the tax obligation ramifications and taking the required steps to establish a count on can aid strengthen your heritage for future generations.

Report this page